When Do You Have To Pay Stamp Duty In Scotland

The LBTT calculators and rates have been updated following the end of the LBTT holiday on 31st March 2021. How and when do I pay Stamp Duty Land Tax.

Stamp Duty Land Tax Trusts The Society Of Will Writers

Stamp Duty Land Tax Trusts The Society Of Will Writers

Your solicitor or conveyancer will usually calculate and pay your stamp duty bill on your behalf.

When do you have to pay stamp duty in scotland. The move was aimed at helping buyers whose finances. 09072020 It sees a temporary change where home buyers will pay no STLD on the first 500000 of the property - with it coming into effect on July 8. If you exchanged on or before 31 March but completed after 31 March then youll have missed the deadline and will need to pay the normal rate of stamp duty.

The level at which it starts having to be paid was raised from 125000 to 500000 in July 2020. When do you pay stamp duty. If youre buying your main property up until 30 June 2021 you will not have to pay Stamp Duty on properties costing up to 500000.

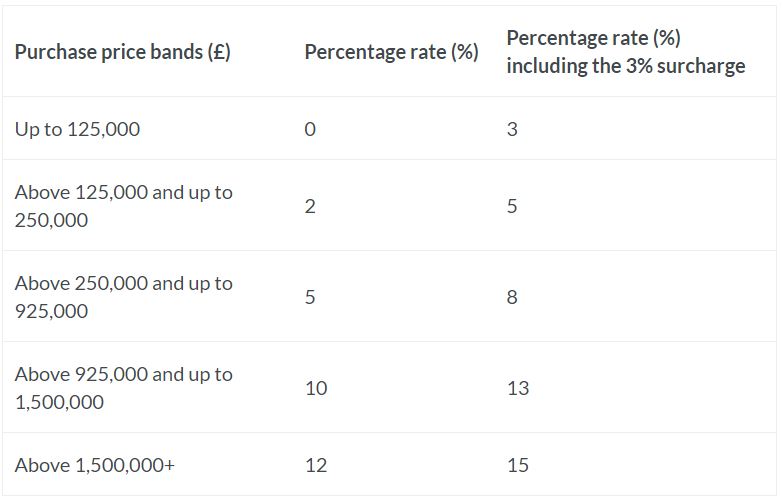

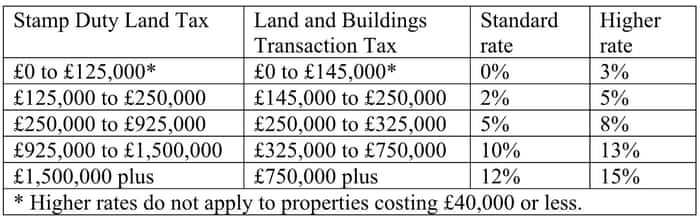

If youre buying a home in England or Northern Ireland and paying more than 125000 you will have to pay Stamp Duty Land Tax SDLT or more than 40000 for second homes. 05052021 This means you if you buy a house for 625000 during this time you would pay 6250 SDLT with 0 on the first 500000 and 5 on the remaining 125000 Rates from 1. Its a tiered tax meaning you pay different rates on different portions of the property price.

05052015 You must pay Stamp Duty Land Tax SDLT if you buy a property or land over a certain price in England and Northern Ireland. The 14 day period for submitting a stamp duty return has been effective from March 2019 and has been reduced from 30 days. 01042021 You have 14 days after you complete on the purchase of a property to file a return to HMRC and pay any stamp duty that is due.

Ad Find China Manufacturers Of Floor Tiles Vinyl. Stamp Duty is a tax you might have to pay if you buy a residential property or a piece of land in England or Northern Ireland over a certain price. Ad Find China Manufacturers Of Floor Tiles Vinyl.

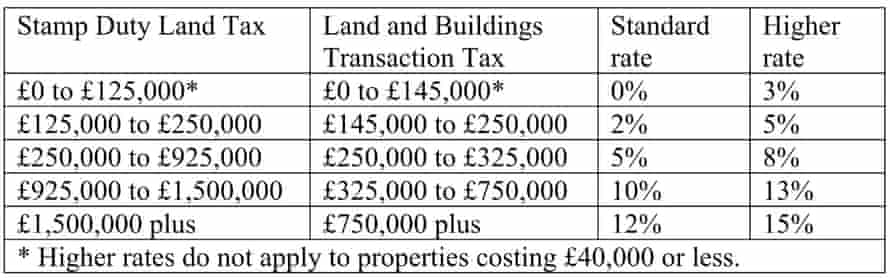

Stamp duty in Scotland is now called land and buildings transaction tax LBTT. Im buying an additional property will the stamp duty holiday benefit me. 19042021 Stamp duty is a tax paid on property purchases.

Until 2015 those purchasing properties in Scotland had to pay stamp duty but this is devolved and was replaced with LBTT in 2015. You must pay Stamp Duty Land Tax SDLT if you buy a property or land over a certain price in England and Northern Ireland. Instead you pay Land and Buildings Transaction Tax when you buy a property.

07072014 Youll pay Land and Buildings Transaction Tax LBTT on land transactions in Scotland from 1 April 2015. UPDATE - 8th July 2020 - First time buyers SDLT relief is replaced by the UK Governments temporary SDLT holiday. Stamp duty now needs to be paid within 14 days after completing on a property purchase.

This calculator will help you work out how much you have to pay if you are buying residential property. 11122018 You have 14 days from the date of completion to pay your stamp duty. Stamp duty in Scotland The Scottish LBTT system is.

You wont pay Stamp Duty Land Tax. The tax is different if the property or land is in. This stamp duty holiday will last until March 31 2021.

10092018 You need to have completed by the 31 March to benefit from the stamp duty holiday in Scotland. Stamp Duty Land Tax no longer applies in Scotland. You must file an SDLT return and pay the tax within 14 days of taking possession of your new property for transactions that took place on or before 28 February 2019 the time limit was 30 days.

04122017 Land and Buildings Transaction Tax LBTT is a tax that you usually have to pay when buying a property in Scotland. What about Stamp Duty SDLT relief and discounts for First Time Buyers in Scotland. The date of completion is the day the purchase is finalised and your solicitor or conveyancer pays any remaining purchase money to the sellers solicitor its usually the.

This tax applies to both freehold and leasehold properties and whether you are buying outright or getting a.

Scotland Urged To Follow Suit In Extending Stamp Duty Holiday Propertywire

Scotland Urged To Follow Suit In Extending Stamp Duty Holiday Propertywire

Do New Stamp Duty Taxes Mean Bye Bye Buy To Let Buying To Let The Guardian

Do New Stamp Duty Taxes Mean Bye Bye Buy To Let Buying To Let The Guardian

Access Bank Offers To Pay Customers February To April Stamp Duty Charges Finance Retail Banking Bank

Access Bank Offers To Pay Customers February To April Stamp Duty Charges Finance Retail Banking Bank

The Implications Of The Uk S New Stamp Duty Rates Blog Rettie Co

The Implications Of The Uk S New Stamp Duty Rates Blog Rettie Co

What Bubble At The Moment After Pent Up Demand And Changes In Stamp Duty The Property Market Has Gone Cray Cr Stamp Duty Property Marketing Investing

What Bubble At The Moment After Pent Up Demand And Changes In Stamp Duty The Property Market Has Gone Cray Cr Stamp Duty Property Marketing Investing

How Much Money Would You Save Through The Stamp Duty Holiday Mummy Matters Stamp Duty House Purchasing Buying Property

How Much Money Would You Save Through The Stamp Duty Holiday Mummy Matters Stamp Duty House Purchasing Buying Property

What Does The Scottish Government Stamp Duty Holiday Mean For The Housing Market

What Does The Scottish Government Stamp Duty Holiday Mean For The Housing Market

Does The 3 Stamp Duty For Second Properties Apply In Scotland Money The Guardian

Does The 3 Stamp Duty For Second Properties Apply In Scotland Money The Guardian

Insight Stamp Duty Land Tax For Uk Property Next Steps

Insight Stamp Duty Land Tax For Uk Property Next Steps

What Is Happening To House Prices In The Uk House Prices Investment Property Greater London

What Is Happening To House Prices In The Uk House Prices Investment Property Greater London

What Is Stamp Duty Updated 2021 Aspen Woolf

What Is Stamp Duty Updated 2021 Aspen Woolf

Stamp Duty Rate Calculator Property Land Tax Calculator

Stamp Duty Rate Calculator Property Land Tax Calculator

Does The 3 Stamp Duty For Second Properties Apply In Scotland Money The Guardian

Does The 3 Stamp Duty For Second Properties Apply In Scotland Money The Guardian

Post a Comment for "When Do You Have To Pay Stamp Duty In Scotland"