Stamp Duty Buyer Or Seller Pay

The seller pays the stamp duty only if there is an agreement stating the sameAsk your questions and get reviews property guidance from property experts. Which are the instruments that attract the payment of Stamp Duty.

In a tweet he claimed that shifting the burden from buyer to seller is NOT being looked at.

Stamp duty buyer or seller pay. In England and Northern Ireland until the end of June you dont have to pay any stamp duty if you are purchasing a property worth less than 500000 unless it is a second home. It is only be applicable if you bought a residential propertyland on or after 20 February 2010. 25092019 A KPMG report has suggested that making sellers pay Stamp Duty rather than buyers could provide a.

Section 30 of the Bombay Stamp Act states the liability of the buyer to pay the stamp duty. Click Pay Stamp Duty. This exemption is available until May.

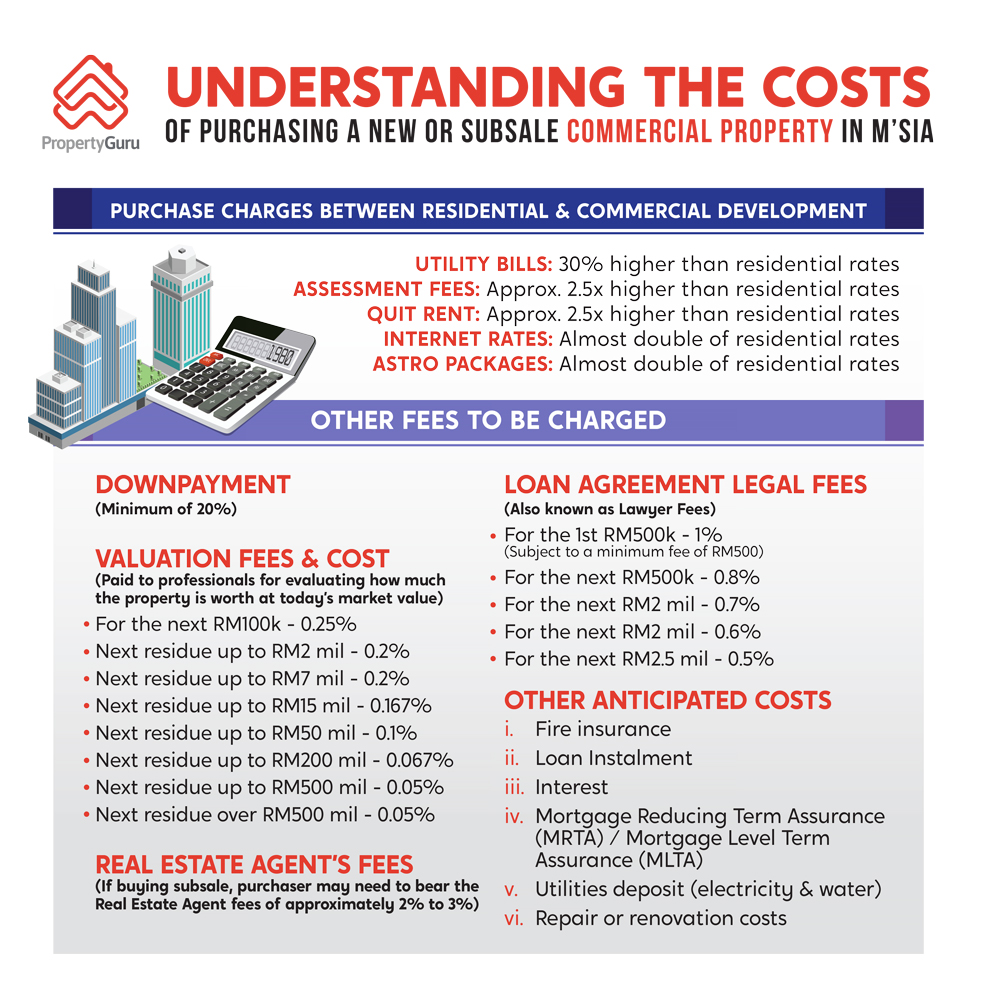

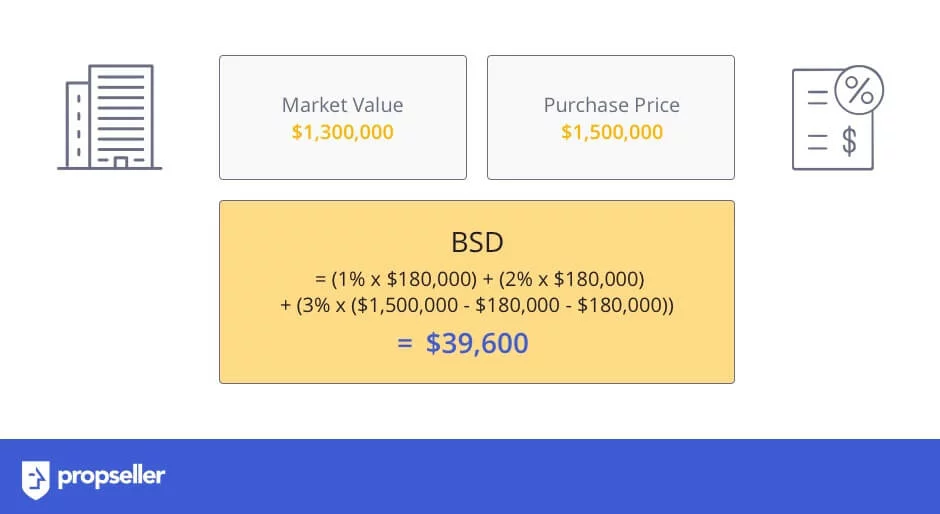

04022021 Note that some developers may absorb the legal fees but you will always need to pay the stamp duty yourself as a buyer. However the property developer must offer a 10 discount on selling prices to qualify under the HOC campaign. 1 on first 180000 2 on next 180000 and 3 on remainder.

As mentioned currently its the buyer who will pay the stamp duty on a property but both the Conservatives and Labour Party have floated plans to switch this to the home seller. This applies for buyers of properties priced between RM300000 to RM25 million with the fee exemption applicable to the first RM1 million. Real Property Gains Tax RPGT One thing you should take into account is the possibility of you eventually selling the house in the future.

This is often done through a solicitor on your behalf as part of the buying process according to. Figures released by HMRC show that 241000 first-time buyers have benefited from First Time Buyers Stamp Duty Relief FTBR which helps most but not all first-time buyers avoid paying. 09072020 Home buyers always pay for stamp duty not the seller.

Stamp certificate available immediately. The individual who pays Stamp Duty is always the buyer even if the seller is looking for a fast house sale the value of which can change depending on the circumstances. To be clear.

13022019 There are a standard set of rules within the UK determining when where and how much stamp duty should be paid during a transition of property ownership. Who is liable to pay Stamp Duty-the buyer or the seller. The current 1 threshold is 125000 the 3 threshold is 250000 and the.

Non-corporate account Payment limit of 200000. Must have a DBS POSB personal bank account ie. Pay lower or no stamp duty fees to buy a new property.

One advantage of this is to help first-time buyers to avoid paying the tax and help those families wanting to buy larger properties. 21082019 According to Sajid Javid the stamp duty speculation is just that speculation. How much is stamp duty in Victoria.

Here are some of the most common Stamp Duty questions along with the best way to answer the questions about stamp duty Malaysia 2021. Until then they dont receive title to the property. 01042021 It is always the home buyer who pays stamp duty not the seller.

Usually your solicitor will pay it on your behalf as part of the purchase process. 08052021 In March the government announced an extension to the stamp duty holiday launched last year for England and Northern Ireland. 01022019 The Association of Accounting Technicians AAT argues that switching the stamp duty liability from the buyer to the seller would make the housing system fairer.

20062007 If you do decide to buy another home then if its purchase price is above the stamp duty threshold you must pay the tax. More speculation about stamp duty this morning. Until 30 June the first 500000 spent on a property will be tax-free.

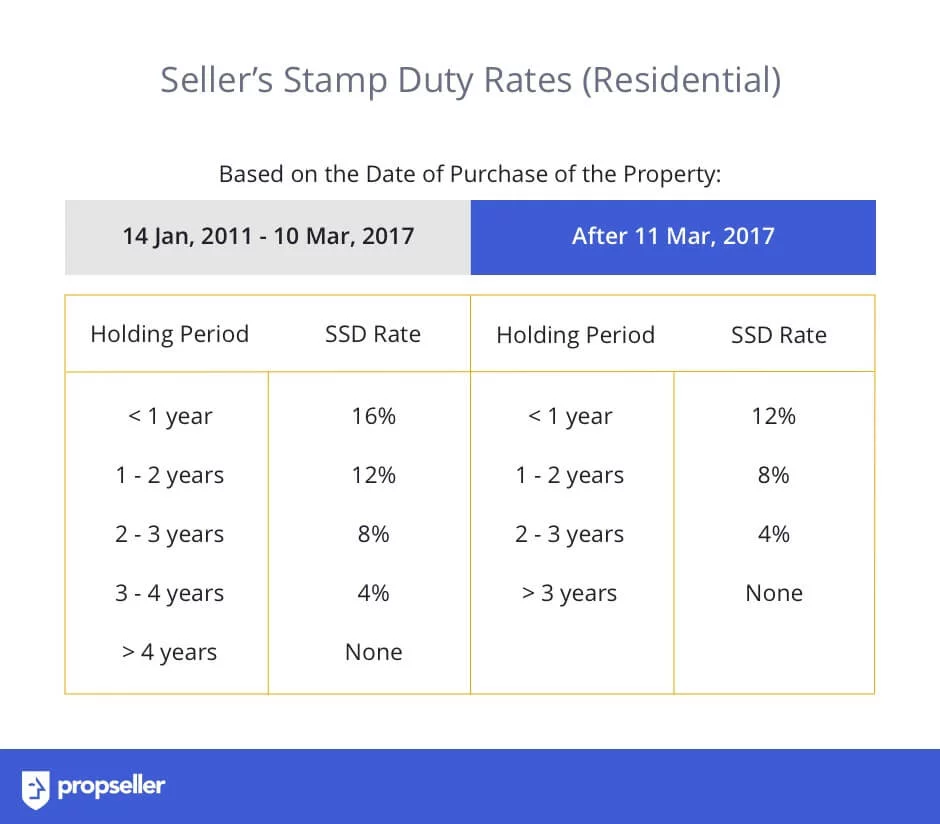

How much is Sellers Stamp Duty. 28022021 Sellers Stamp Duty or SSD is a tax that a property seller has to pay if heshe sells the property within three years of owning it. If house prices rise and sellers pay.

16052017 Generally stamp duty is paid at settlement by the buyer who has up to 30 days to pay. For Buyers Stamp Duty Additional Buyers Stamp Duty Sellers Stamp Duty. Find thousands of real estate property questions.

17012012 First because stamp duty is in general a rotten tax paid regardless of whether you have made any gains or not. This may be because you might want to upgrade leave the area for a new job find a.

Buying A House Here S 2020 Stamp Duty Charges Other Costs Involved

Buying A House Here S 2020 Stamp Duty Charges Other Costs Involved

Stamp Duty In Singapore The Ultimate Guide 2020 Update Propseller

Stamp Duty In Singapore The Ultimate Guide 2020 Update Propseller

Https Blog Bluenest Sg Seller Stamp Duty

Property Stamp Duty The Ultimate Guide To Ssd Bsd And Absd

Property Stamp Duty The Ultimate Guide To Ssd Bsd And Absd

Stamp Duty And Administration Fee For Tenancy Agreement Propertyguru Malaysia

Stamp Duty And Administration Fee For Tenancy Agreement Propertyguru Malaysia

Stamp Duty In Singapore The Ultimate Guide 2020 Update Propseller

Stamp Duty In Singapore The Ultimate Guide 2020 Update Propseller

Property Stamp Duty The Ultimate Guide To Ssd Bsd And Absd

Property Stamp Duty The Ultimate Guide To Ssd Bsd And Absd

The Complete Guide To Buying New Subsale Or Commercial Property In Malaysia Propertyguru Malaysia

The Complete Guide To Buying New Subsale Or Commercial Property In Malaysia Propertyguru Malaysia

Stamp Duty In Singapore The Ultimate Guide 2020 Update Propseller

Stamp Duty In Singapore The Ultimate Guide 2020 Update Propseller

Stamp Duty In Singapore The Ultimate Guide 2020 Update Propseller

Stamp Duty In Singapore The Ultimate Guide 2020 Update Propseller

Paying Stamp Duty On Property Not As Easy As 1 2 3 Business News Top Stories The Straits Times

Paying Stamp Duty On Property Not As Easy As 1 2 3 Business News Top Stories The Straits Times

Buying A House Here S 2020 Stamp Duty Charges Other Costs Involved

Buying A House Here S 2020 Stamp Duty Charges Other Costs Involved

Https Blog Bluenest Sg Seller Stamp Duty

The Complete Guide To Buying New Subsale Or Commercial Property In Malaysia Propertyguru Malaysia

The Complete Guide To Buying New Subsale Or Commercial Property In Malaysia Propertyguru Malaysia

Stamp Duty In Singapore The Ultimate Guide 2020 Update Propseller

Stamp Duty In Singapore The Ultimate Guide 2020 Update Propseller

How To Calculate Avoid Paying Seller Stamp Duty Bluenest Blog

How To Calculate Avoid Paying Seller Stamp Duty Bluenest Blog

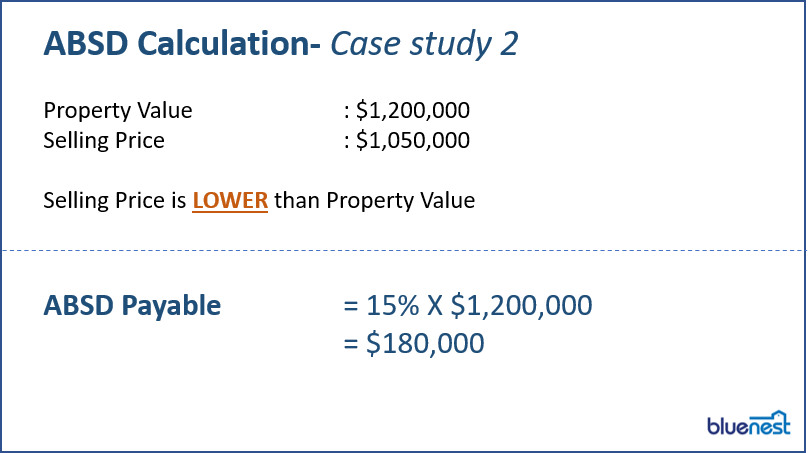

7 Things To Know About Absd For Your 2nd Property Bluenest Blog

7 Things To Know About Absd For Your 2nd Property Bluenest Blog

Post a Comment for "Stamp Duty Buyer Or Seller Pay"