Stamp Duty On Buy Back Of Shares In India

09072008 Further along with Form A. However the stamp duty payable on such transfer after 1st April 2020 has been reduced to 0015 of the sale consideration.

Https Www Jstor Org Stable 40913079

02022015 The seller must pay stamp duty at the rate of Rs 025 for every Rs 100 of share.

Stamp duty on buy back of shares in india. Of shares buy-back cannot be equated with transfer. The mechanism for payment of stamp duty on the demat securities has drastically been changed for demat shares. 25092020 For delivery trading STT is charged on both sides buy.

When can a Company come up with Buyback offer. Under 8A of the Indian Stamp Act securities issued in electronic form need not be stamped provided the issuer pays stamp duty on the total amount of. In the State of Maharashtra stamp duty on issue of share certificates is 01.

It doesnt matter whether shares are in physical or demat mode. Sell of transactions and is equal to 01 of the total transaction price on each side of trading. Customs HMRC for stamping.

Special adhesive stamps bearing the word share transfer shall be used for stamping for share transfers. Tax shall be deposited within 14 days from the date of payment of consideration to the shareholder. 02022018 No Stamp Duty is payable in case of buyback of shares as the company is buying back its own shares.

Provision is mandatory in nature irrespective of whether the company is liable to tax or not or not. Such buy-back tax has been extended to listed companies vide Finance Act 2019. 25032021 India tax laws levy buy-back tax at the rate of 23296 percent on the buy-back of shares by an unlisted company to the extent of the amount distributed over the amount received by the company from the shareholders on issuing the shares.

B all Members should submit Clearing List delivery and non-delivery based transactions for cash and derivatives separately in hard copy together with the remitted stamp duty in two sets between 1st and 10th of every month on Counter No34 of BOI Shareholding Ltd. 16082016 Stamp duty is levied on documents in accordance with Schedule 1 of the Indian Stamps Act 1899. 025 for every hundred rupees.

STAMP DUTY ON BUY BACK. The Company is not liable to pay Stamp Duty. A company can use a maximum of 25 per cent of the aggregate of its available free reserves and paid-up capital for the process ofthe buyback.

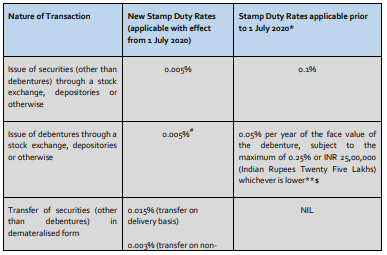

10- each at a price of Rs. The Indian Stamp Act 1899 is a Central enactment and States have powers to adopt the Indian Stamp Act 1899 with amendments to. 21102020 Rates of Stamp Duty.

06022016 Tax Liability of the Company Buy back price 2266. Cash offer to buy-back up to 1488 Eq. Where stamp duty is payable by the company on the purchase the form should first be sent with a cheque for the stamp duty to HM Revenue.

Transfer of shares of unlisted companies was subject to Stamp Duty at the rate of 025 of the value of shares in accordance with Indian Stamp Act 1899 Article 62 Schedule I. The book value per Eq. 21102020 Since as per the proviso to sub-rule 3 of rule 6 of the Rule The Indian Stamp Collection of Stamp Duty through Stock Exchanges Clearing Corporations and Depositories Rule 2019 it is mentioned that that fresh issue will be subject to stamp duty however as per section 9A1c stamp duty in case of the fresh issue to be based on the market value however as.

Stamp Duty on Transfer of Shares under Indian Stamp Act o The Government of India Ministry of Finance Department of Revenue has fixed the stamp duty on transfer of shares at the rate of twenty-five paise Re. 20062016 One may note that transfer. Since stamp duty is payable on transfer.

04072015 The Company is liable to pay 20 tax of Consideration received by shareholder under Buyback - amount received by Co on issue of such. For intraday and derivate trading futures and options STT is charged only when you sell the stock. 25 rows 07082016 Stamp duty is a certain amount of money levied on value of shares.

19022018 Once the buyback of shares has been made the Companies House form SH03 should be completed. Of shares attracts stamp duty vide Schedule I Entry 62 to the Indian Stamp Act 1899. Transfer of shares to be complete requires the company to register the shares bought back in its name.

Share as at 31032015 works out to Rs. Stamp duty on share buyback If the purchase price exceeds 1000 the company pays ad valorem stamp duty on the purchase price of shares. We will deal with stamping and notifications required to HMRC.

Every issue of shares under a letter of allotment or certificate or other document evidencing title thereto is required to be stamped in accordance with the provisions of law prevailing in the State in which it is issued. 14042014 Regarding buy back offer of CAPRICON REALTY LTD. Its now 0005 on issue of Share Certificates and 0015 on transfer of shares.

Stamp Duty And Administration Fee For Tenancy Agreement Propertyguru Malaysia

Stamp Duty And Administration Fee For Tenancy Agreement Propertyguru Malaysia

Maharashtra Stamp Duty And Registration Charges April 2021 An Overview

Maharashtra Stamp Duty And Registration Charges April 2021 An Overview

Maharashtra Stamp Duty And Registration Charges April 2021 An Overview

Maharashtra Stamp Duty And Registration Charges April 2021 An Overview

Reference And Revision Under Indian Stamp Act Ipleaders

Reference And Revision Under Indian Stamp Act Ipleaders

Who Ll Benefit From Unified Stamp Duty

Who Ll Benefit From Unified Stamp Duty

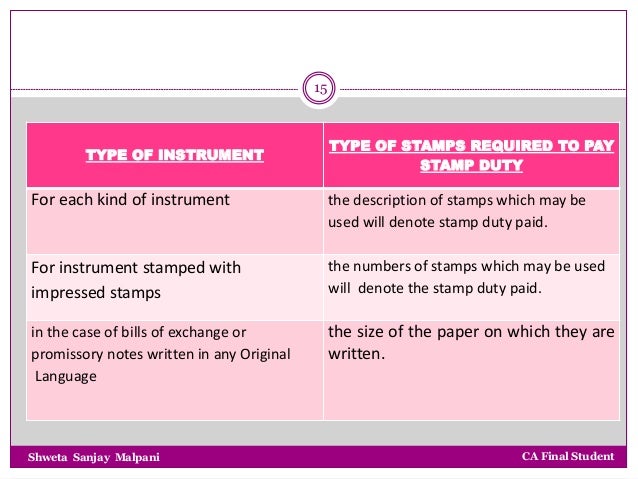

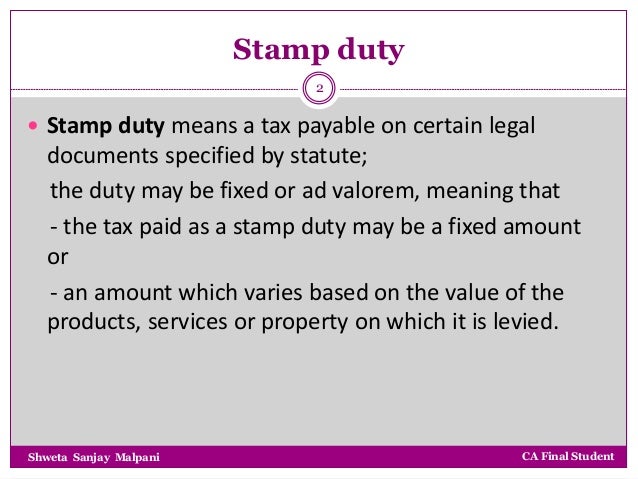

Types Of Stamps And Some Concepts Of Stamp Duty

Types Of Stamps And Some Concepts Of Stamp Duty

Types Of Stamps And Some Concepts Of Stamp Duty

Types Of Stamps And Some Concepts Of Stamp Duty

Stamp Duty And Administration Fee For Tenancy Agreement Propertyguru Malaysia

Stamp Duty And Administration Fee For Tenancy Agreement Propertyguru Malaysia

Stamp Duty Explained With Example

Stamp Duty Explained With Example

Property Stamp Duty Registration Charges In India Property Marketing Stamp Duty Real Estate Marketing

Property Stamp Duty Registration Charges In India Property Marketing Stamp Duty Real Estate Marketing

Types Of Stamps And Some Concepts Of Stamp Duty

Types Of Stamps And Some Concepts Of Stamp Duty

Types Of Stamps And Some Concepts Of Stamp Duty

Types Of Stamps And Some Concepts Of Stamp Duty

Types Of Stamps And Some Concepts Of Stamp Duty

Types Of Stamps And Some Concepts Of Stamp Duty

Types Of Stamps And Some Concepts Of Stamp Duty

Types Of Stamps And Some Concepts Of Stamp Duty

Post a Comment for "Stamp Duty On Buy Back Of Shares In India"