Who Should Pay Stamp Duty For Tenancy Agreement Singapore

A Sale and Purchase document that you are paying stamp duty on. 11282016 Usually tenants are responsible for paying the stamp duty unless otherwise stated in the tenancy or lease agreements.

99 Co S Guides Buying Property In Singapore As A Foreigner

99 Co S Guides Buying Property In Singapore As A Foreigner

For novation or assignment of a lease between tenants stamp duty is payable on the consideration paid by the new tenant to the original tenant at the buyers stamp duty rates.

Who should pay stamp duty for tenancy agreement singapore. 5162018 So who pays for the stamp duty. The Sales and Purchase Agreement between homebuyer and seller or the Tenancy Agreement between landlord and tenant if youre renting legally recognised. Lease or tenancy agreement.

1162017 Stamp duty is a tax payable to the Inland Revenue Authority of Singapore IRAS by the tenant upon signing the Tenancy Agreement. Please attach this with your cheque payment and write the 14-digit payment slip number on the reverse side of your cheque or cashiers order made payable to. Stamp Duty for Variable Capital Companies.

However should you choose to sell it within the minimum holding period you would be liable to pay an SSD. The rental stamp duty should be paid within 14 days if the tenancy agreement is signed in Singapore. Stamp Duty on leases is payable based on the contractual rental or the market rental whichever is higher at the Lease Duty rates.

This is however a grey area and usually no penalty will be levied if the stamp duty is paid within 14 days of the tenancy agreement being signed in Singapore and 30 days if it is being signed overseas. 8272019 Property Stamp Duty in Singapore Stamp duty is a tax you have to pay in order to have your documents ie. Fixed and Nominal Duties.

932020 stamping fees and paperwork agreement is charges lumpsum to tenant for renewal tenancy agreement from existing tenant is 50 of rental fees to negotiator should they follow up the case. Singapore Citizen Singapore PR foreigner or company. Stamp Duty Basics for Property.

It is common practice in Singapore for the tenants to pay the rental stamp duty for tenancy agreements. B Particulars of the parties involved including the following for the purchaser. All monetary amounts stated or referred to in this Lease are based in the Singapore dollar.

The TA is the only contractual document given to tenants for their right to remain in this premise and also gives the landlord the right to dissue the contract with the expiry clause zBB if the tenants have not paid the rent at the hourly limit. 12212020 Stamp duty circumvention is a serious offence in SingaporeIn most ATTs are the responsibility of the tenant. E-Stamping and Where to e-Stamp Documents.

14 rows Who Should Pay Stamp Duty Check the terms of the document eg. 8242020 As a tenant of rental units in Singapore your agent or landlord will most likely let you know that rental stamp duty needs to be paid according to government policies to the Inland Revenue Authority of Singapore IRAS the statutory body responsible for. Stamp duty is payable on documents relating to leases of immovable properties in Singapore such as.

Who Should Pay Stamp Duty. Stamp duty is payable on the consideration paid by the landlord to the tenant at the buyers stamp duty rates. Only after the Tenancy is stamped then it can be considered a valid contract as evidence in court for any disputes that may arise in the future with your landlord.

Print the payment slip from the e-Stamping Portal. Tenants should ensure that tenancy agreements for rental of rooms rental of whole property units and renewal of leases are duly stamped. This is to protect the interest of both parties.

The Tenant will pay all stamp fees for this Lease and any related documents in duplicate. When the terms do not state who is liable the party to pay Stamp Duty will follow that as specified in the Third Schedule of the Stamp Duties Act. 1222020 When you buy a property in Singapore you have to keep it for a minimum holding period the period after you claim ownership of the property and before you sell it to avoid paying a Sellers Stamp Duty SSD.

Do I need to pay stamp duty for a Surrender of Lease. A room or when the landlord renews or extends the lease. Tenancy agreement to determine who is contractually required to pay the Stamp Duty.

Verifying the Authenticity of Stamp Certificate. It should be paid when the tenant rents the whole house or part of a house eg. 11242020 The standard practice is for the tenancy agreement to be stamped and the stamp duty to be paid before the landlord and the tenant signs the document.

When should it be paid. Pay with cheque or cashiers order from any bank in Singapore. In Singapore Tenancy Agreement will need to be stamped by the Inland Revenue Authority of Singapore.

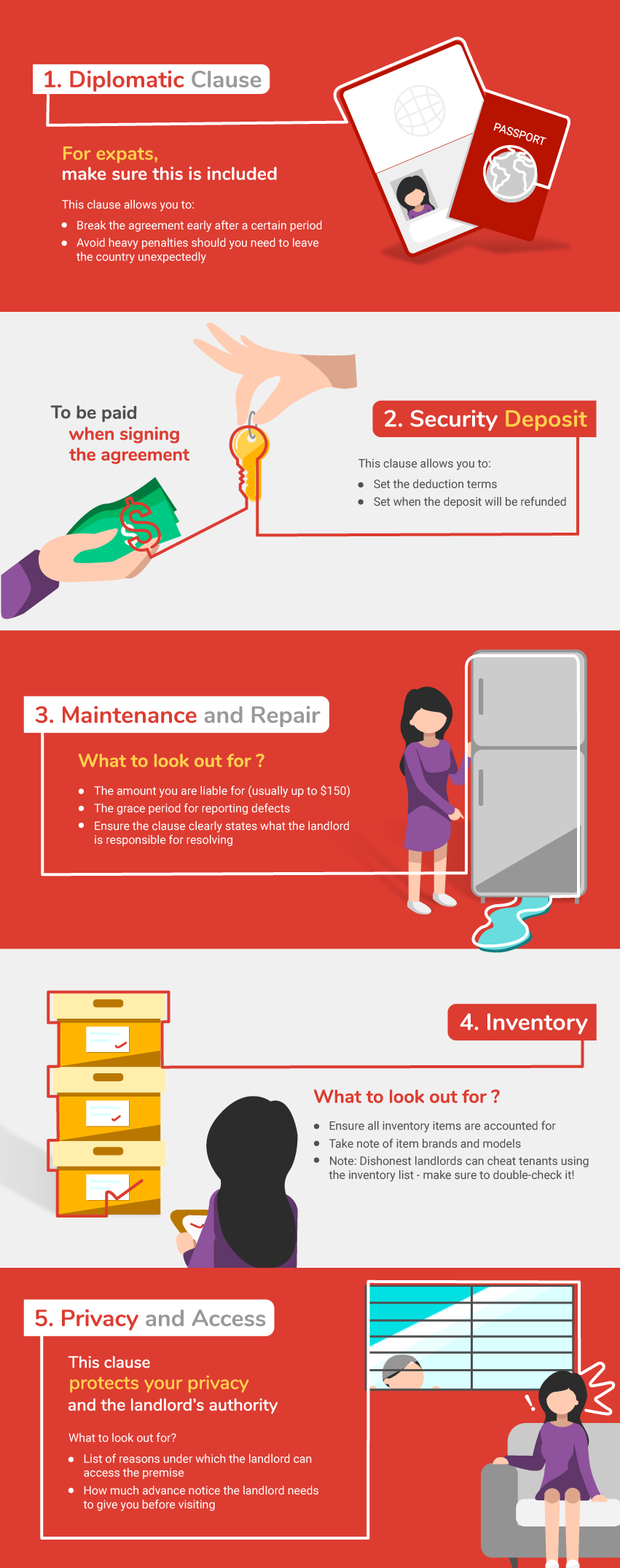

Rental Tenancy Agreement In Singapore What You Must Know Before Signing Propertyguru Singapore

Rental Tenancy Agreement In Singapore What You Must Know Before Signing Propertyguru Singapore

Renting In Singapore Everything You Need To Know About Stamp Duty Comfy

Renting In Singapore Everything You Need To Know About Stamp Duty Comfy

Guide Breaking Lease And Early Termination Of Tenancy Agreement 99 Co

Guide Breaking Lease And Early Termination Of Tenancy Agreement 99 Co

Landlord And Tenants Rights In Spain Advocate Abroad

Landlord And Tenants Rights In Spain Advocate Abroad

Renting In Singapore Everything You Need To Know About Stamp Duty Comfy

Renting In Singapore Everything You Need To Know About Stamp Duty Comfy

Https Blog Bluenest Sg Seller Stamp Duty

Https Blog Bluenest Sg Seller Stamp Duty

Guide Breaking Lease And Early Termination Of Tenancy Agreement 99 Co

Guide Breaking Lease And Early Termination Of Tenancy Agreement 99 Co

Renting In Singapore Everything You Need To Know About Stamp Duty Comfy

Renting In Singapore Everything You Need To Know About Stamp Duty Comfy

Guide To Letters Of Intent For Property Rentals In Singapore Singaporelegaladvice Com

Guide To Letters Of Intent For Property Rentals In Singapore Singaporelegaladvice Com

How Can I Find Out If Tenancy Agreement Is Stamped Singapore Expats Forum

How Can I Find Out If Tenancy Agreement Is Stamped Singapore Expats Forum

Rental Tenancy Agreement In Singapore What You Must Know Before Signing Propertyguru Singapore

Rental Tenancy Agreement In Singapore What You Must Know Before Signing Propertyguru Singapore

Renting In Singapore Everything You Need To Know About Stamp Duty Comfy

Renting In Singapore Everything You Need To Know About Stamp Duty Comfy

Additional Buyer S Stamp Duty Absd What Are Your Options In 2019 Singapore Property News Resource All The Info You Need About Hdb Resale Singapore Condos New Launches And Landed Properties

Additional Buyer S Stamp Duty Absd What Are Your Options In 2019 Singapore Property News Resource All The Info You Need About Hdb Resale Singapore Condos New Launches And Landed Properties

Additional Buyer S Stamp Duty Absd What Are Your Options In 2019 Singapore Property News Resource All The Info You Need About Hdb Resale Singapore Condos New Launches And Landed Properties

Additional Buyer S Stamp Duty Absd What Are Your Options In 2019 Singapore Property News Resource All The Info You Need About Hdb Resale Singapore Condos New Launches And Landed Properties

How To Calculate Avoid Paying Seller Stamp Duty Bluenest Blog

How To Calculate Avoid Paying Seller Stamp Duty Bluenest Blog

Rental Tenancy Agreement In Singapore What You Must Know Before Signing Propertyguru Singapore

Rental Tenancy Agreement In Singapore What You Must Know Before Signing Propertyguru Singapore

Rental Tenancy Agreement In Singapore What You Must Know Before Signing Propertyguru Singapore

Rental Tenancy Agreement In Singapore What You Must Know Before Signing Propertyguru Singapore

Post a Comment for "Who Should Pay Stamp Duty For Tenancy Agreement Singapore"